Will cash remain king

Cash has been one of the best performing defensive assets over the past three years. When compared with global bonds (a riskier asset class), a typical portfolio of term deposits would have returned a cumulative 12.6% in comparison to -8.5% for global bonds over the three years to December 2023. With interest rates expected to stay higher for longer, cautious investors would be right to question whether other asset classes are worth the risk. But are the tides changing?

On paper cash still appears to be king; however, these healthy returns are attributed to accelerated inflation and rising interest rates, an environment we may be moving away from. Inflation has been trending downwards for months and rate cuts are predicted to begin before the end of 2024.

In this paper we explain why we believe now is a good time to revisit your asset allocation.

What is a bond?

A bond is a loan made by an investor to a borrower, generally a company or government. Typically, the borrower pays the investor interest (coupons) periodically over the term of the loan and then returns the initial value (principal) of the loan back to the investor at an agreed upon future date.

Bond values are linked to the borrowers perceived ability to pay back the loan as well as interest rates. For example, when interest rates rise, newly issued bonds offer higher coupons, making them more attractive and equivalent existing bonds with lower coupons less attractive, reducing their value.

How do bonds differ from term deposits?

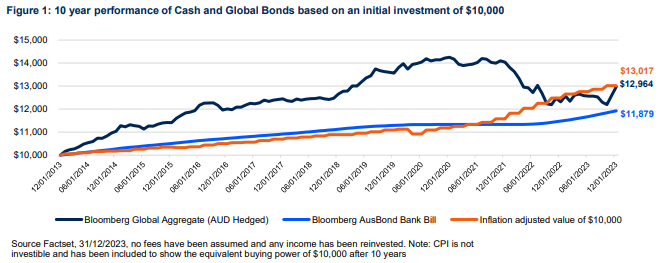

Bonds are expected to provide higher returns over the long term because investors require compensation for assuming investment risk. Bonds also provide the opportunity for capital growth as well as higher income. This compares with term deposits where interest payments are lower but guaranteed by a bank – providing more security. Whilst income is guaranteed, the real value of a term deposit often diminishes over time due to inflation, which erodes your purchasing power (figure 1).

Figure 1 also shows that bonds are subject to greater risk over shorter time horizons which means they won’t be suitable for everyone. Your initial investment can go down in value and when you invest in funds this can be offset through the distributions, reducing your income. This primarily occurs when interest rates are rising and become unpredictable as they have in recent times.

Investors need to determine, with support from their adviser, whether trading term deposits capital guarantee for the potential increased return of a bond investment is suitable to their circumstances.

Why now?

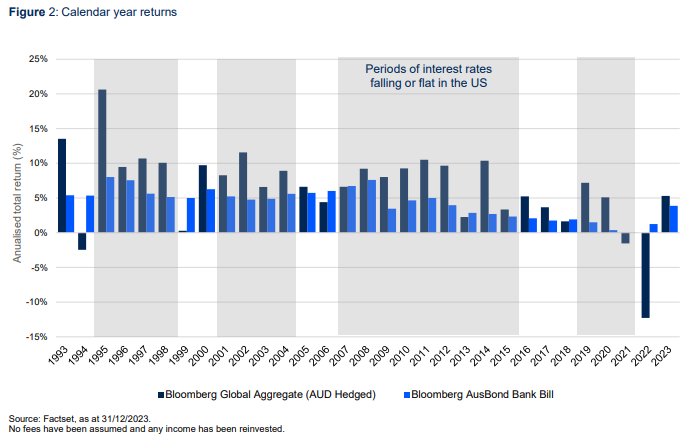

In an environment where inflation is trending down and rates are expected to be cut, long term bonds should perform well as this is the environment when you typically experience the most capital growth (see figure 2). Term deposit rates are also forward looking. In other words, you don’t need to wait for central banks to reduce cash rates before you start to see term deposit returns fall. There are already signs of this happening. Whilst very recent, 1-year term deposit rates came down by 0.05% in January and we expect this trend to continue (although this won’t necessarily be a smooth journey). Whilst seemingly insignificant, this could be meaningful for larger investors. Particularly where capital growth has no role to play and investors don’t require the capital guarantee of cash.

What happens if the economy deteriorates?

If a recession were to occur, interest rates are more likely be cut quicker to encourage spending, resulting in bond prices rising. This would be supported by increased demand as investors move away from higher risk assets such as equities. If we don’t enter a recession and achieve a soft-landing scenario, rates will likely trend down more slowly to bring inflation in line with central banks’ targets; once again favouring bonds due to the inverse relationship between interest rates and bond values.

Conclusion

We believe it is critical to take a diversified approach to investing to help manage portfolio risks through different market conditions. The balance and mix of assets will depend on each investor’s ability and willingness to take on investment risk as well as how much of their capital they need guaranteed.

That said, we believe now is a great time to be reassessing your asset allocation. Investors looking for capital growth who don’t need capital guarantees should consider introducing bonds into, or back into, their investment portfolio and doing so before central banks begin to cut rates.

While cash rates may seem alluring, it is important to remember the distinct roles bonds and cash play in a portfolio. Cash is best reserved for short-term spending needs that require a guarantee as it will not provide the long-term capital growth and inflation protection of other assets.

It may seem daunting as we have been through a period of significant market volatility but over the long term, we have high conviction that bonds will provide better risk adjusted return outcomes for investors who are able to take on the increased risks offered by bonds.

As always, we recommend speaking to your financial adviser to get tailored advice based on your unique circumstances prior to making any investment changes.

Source: Perpetual